For small businesses, the main goal of reconciling your bank statement is to ensure that the recorded balance of your business and the recorded balance of the bank match up. A bank reconciliation Excel template can help you make short work of this process. If it doesn’t, you’ll have to go back in time or check the audit trail to find the transaction or transactions that changed. https://www.quickbooks-payroll.org/ But even if you’re not subject to Sarbanes-Oxley, reconciling accounts — especially cash accounts— on a timely basis can help prevent fraud. We’ve all heard of small businesses that lose tens of thousands, even hundreds of thousands, to embezzlement. Many of those thefts could have been halted in their tracks immediately if the bank accounts had been reconciled regularly.

How to reconcile your accounts for your business

Open-source products, like Odoo, are ideal for business owners who know how to code and want to play a hands-on role in customizing the product to fit their business needs. Offers industry-specific features for consulting businesses, nonprofits, manufacturing companies, professional services and more. Strong feature set includes thorough record-keeping, invoicing and advanced inventory management and pricing rules. Unlike some competitors that require you to pay extra for a time-tracking module, all FreshBooks plans come with unlimited time tracking.

How Does Reconciliation in Accounting Work?

- It is possible to purchase cloud access so your team can better collaborate and access the software and its data from anywhere, but costs add up quickly with an additional monthly charge per user.

- In these situations, accounting teams greatly benefit from having a collaborative accounts receivable solution, which allows them to communicate directly with customers in a single platform.

- Clio’s Trust Account Management features, for example, allow you to manage your firm’s trust accounting, reconcile directly in Clio, and run built-in legal trust account reports.

- This ensures transactions that are being closed out are properly verified and the closing statements are accurate.

Performing regular balance sheet account reconciliations and reviewing those reconciliations is one form of internal control. Auditors will always include reconciliation reports as part of their PBC requests. These types of account reconciliation are crucial for maintaining financial accuracy, compliance with regulations, and preventing errors or discrepancies that could impact the overall financial health of a business. The frequency and specific processes may vary based on the nature and size of the organization. Account reconciliation is typically carried out by accountants during monthly and year-end financial closing processes.

Akaunting: Don’t be fooled by “free” software

Thankfully, today, transactions are instantaneously communicated within minutes or hours between different records rather than days or weeks. There are several steps involved in the account reconciliation process, depending on the accounts that you’re reconciling. No matter what you’re reconciling, it will involve comparing two sets of records to determine accuracy. That’s why account reconciliation remains a key component of the financial close process. In the event that something doesn’t match, you should follow a couple of different steps. First, there are some obvious reasons why there might be discrepancies in your account.

The frequency of your reconciliation process can be determined by the size and type of business. Whether you’re a small business owner working with multiple sub-ledgers or a multi-million dollar business using an ERP accounting advisory system, reconciling your accounts will always be necessary. Account reconciliation is a financial reconciliation, with no real difference, except for how the results of the reconciliation process will be used.

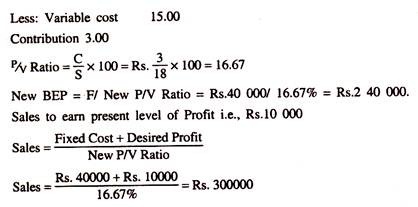

Automate and configure revenue reports to simplify compliance with IFRS 15 and ASC 606 revenue recognition standards. The prior month’s journal entry accruals need to be reversed to prevent a discrepancy. For example, a schedule with beginning balance, cost of new insurance policies or renewals received https://www.accountingcoaching.online/what-are-billable-hours-time-tracking-tips-to-get/ minus amounts amortized for time usage creates the new ending balance for prepaid insurance. Annual SaaS subscriptions are another example of prepaid assets amortized over twelve months as each month elapses. Companies tend to invest in some projects or for taxation purposes or due to many other reasons.

Automation software spares you the inefficient and tedious work involved in account reconciliation. Different automation software, which uses statistical models to provide mostly accurate estimations for this method, is available on the internet. Accounting errors are noted where there is a significant variation from the estimated projection. Upon investigation, the company discovers an accounting error where a zero was omitted and rectifies the record to bring the revenue value to $45 million, which is close to the estimated revenue projected. Depending on the account type, you may also require additional details presenting the whole activities executed on the account. These activities include details of debit and credit transactions in the account.

Having to compare two accounting records helps a company accurately account for all its transactions. Where discrepancies arise, it helps you pinpoint the exact missing transaction and the accounting officer in charge of it. The general ledger balance of an account is compared to independent systems, third-party data, or other supporting documentation to ensure the balance stated in the general ledger is extremely accurate. This process confirms that records of transactions are complete and consistent, helping companies make important business and financial decisions using very accurate records.

Historical details of cash accounts or bank statements are used to identify irregularities, balance sheet errors, or fraudulent activities. One example of where this method is used is a case scenario involving a company that records an average annual revenue of $50 million based on historical records. Reconciliation in accounting—the process of comparing sets of records to check that they’re correct and in agreement—is essential for ensuring the accuracy of financial records for all kinds of businesses. For the legal profession, however, regular, effective reconciliation in accounting is key to maintaining both financial accuracy and legal compliance—especially when managing trust accounts. This saves your company from paying overdraft fees, keeps transactions error-free, and helps catch improper spending and issues such as embezzlement before they get out of control. Check that all outgoing funds have been reflected in both your internal records and your bank account.

While scrutinizing the records, the company finds that the rental expenses for its premises were double-charged. The company lodges a complaint with the landlord and is reimbursed the overcharged amount. In the absence of such a review, the company would’ve lost money due to a double-charge.

Also sometimes called on-premise software, desktop accounting software must be locally installed on a specific computer and can only be accessed from that one device or location. Sage 50 Accounting, unlike some of its competitors, offers inventory management and job costing features at all plan levels. Also included with every plan is Sage’s own cybersecurity offering, which will keep tabs on your business credit score and monitor for data breaches. Business owners working in construction or manufacturing may be especially drawn to Sage 50’s advanced inventory, job costing, reporting and budgeting capabilities.

Deja una respuesta